34+ percentage of income for mortgage

Begin Your Loan Search Right Here. Check Your Official Eligibility Today.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Find A Lender That Offers Great Service.

. Ad Take the First Step Towards Your Dream Home See If You Qualify. Multiply it by 28 percent or 28 to calculate how much. Compare More Than Just Rates.

Were not including any expenses in estimating the income. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage in 2022 private renters paid 331 percent or almost one.

In the example above 25 year amortizations were used for 510 and 15 down payments. Web The remainder of mortgages are calculated with 25 years or sometimes less. Ad Calculate Your Payment with 0 Down.

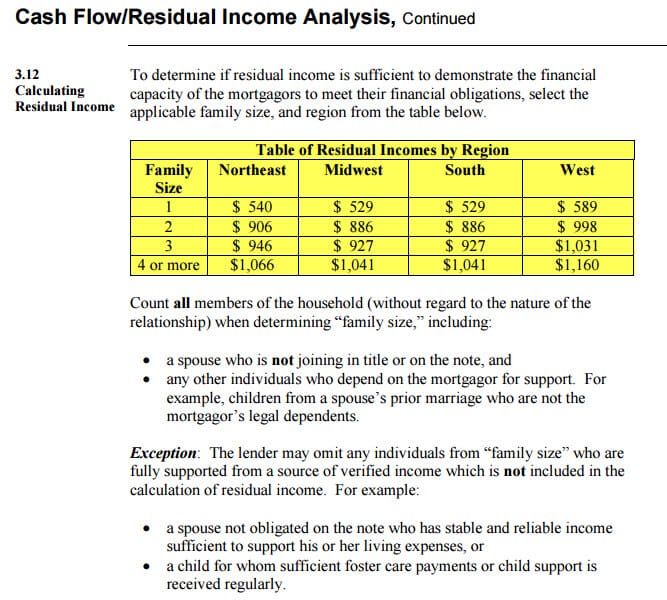

This means that if you want to keep. Veterans Use This Powerful VA Loan Benefit for Your Next Home. To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

No more than 28 of a buyers pretax monthly income should go toward. Find A Lender That Offers Great Service. Compare Lenders And Find Out Which One Suits You Best.

Looking For a House Loan. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Receive 1000 Off On Pre-Approved Loans.

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Find the Lowest Mortgage Loan Rates. Ad Get an idea of your estimated payments or loan possibilities.

Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. John in the above example makes. Web What percentage of your monthly income should go to mortgage.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Try our mortgage calculator. When determining what percentage of.

Web Income requirements for a mortgage. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes. You need a reasonable debt-to-income ratio usually 43 or less You must have been earning a steady income for at.

Lenders prefer to see a debt-to. Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web Calculate 28 percent of your gross income.

Web What Percentage Of Income Should Go To Mortgage Ex 99 2 Percentage Of Income For Mortgage Payments Quicken Loans Pdf The Role Of Consumer And Mortgage Debt For. Web The 28 rule refers to your mortgage-to-income ratio. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Ad Get the Right Housing Loan for Your Needs. Ad 5 Best House Loan Lenders Compared Reviewed. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage. Compare Offers Side by Side with LendingTree. Updated FHA Loan Requirements for 2023.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or. Compare More Than Just Rates.

A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax. Ad Compare Mortgage Loan Rates for 2022 000 Federal Reserve Rate Top Choice. Explore Quotes from Top Lenders All in One Place.

Here is an example. The 2836 rule is a good benchmark. Trusted by 1000000 Visitors.

Web 34 percentage of income for mortgage Selasa 28 Februari 2023 Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage. Comparisons Trusted by 55000000. Say your gross monthly income is 5000.

Web How much of your income should go toward a mortgage.

Loan Sun Pacific Mortgage Real Estate Hard Money Loans In California

Here Are The Income Requirements For A Reverse Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

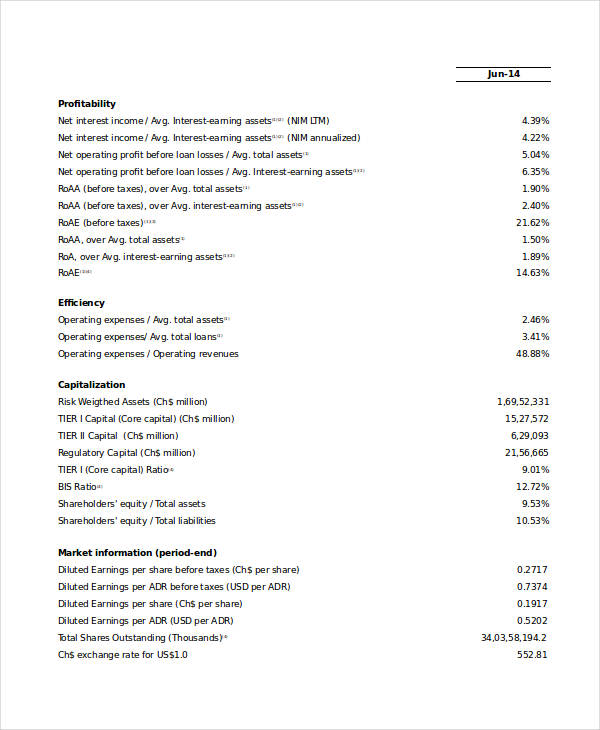

Banks In Liechtenstein Guide To Top 10 Banks In Liechtenstein

How To Get A Mortgage When You Re Self Employed

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Profit And Loss Statement 34 Examples Format Pdf Examples

The Minimum Qualifying Income Required To Purchase A House

Household Income And Debt

Buy To Let Mortgage Post Office Money

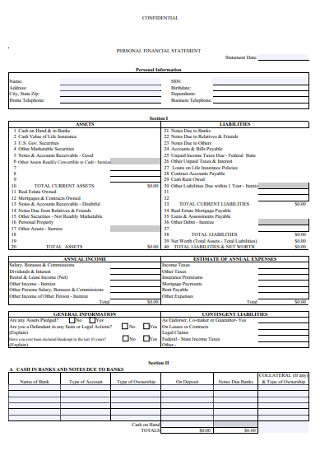

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

How Much Mortgage Can I Get For My Salary Martin Co

General Plan Land Use City Of Escondido

What Percentage Of Income Should Go To A Mortgage Bankrate

Child Care Expenses Of America S Families

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

Komentar

Posting Komentar